Why do economic forecasts require so much adjustment if they are based on reliable economic models? Last week, for example, the release of Statistics Canada figures for July showed a decline in consumer spending that fuelled speculation that the recovery in Canada may be stalling. Predictions for the rest of the year have been adjusted downward as a result.

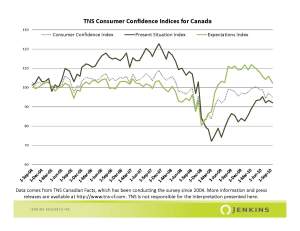

Much of the current economist reaction could have been predicted or understood by looking at consumer confidence. The latest consumer confidence indices suggest that Canadians as a whole are losing confidence and are, perhaps, as confused as economists and the Bank of Canada about the future.

Remember, that when the economy in Canada hit bottom (from a consumer perspective this was in Q1 of 2009), Canadians were quite pessimistic about the present (at that time) and the future.

The public, however, is quite resilient and quickly saw better times on the horizon, even as they remained quite pessimistic about their current situation. And that optimism about the future may have (along with other real indicators) have contributed to a growing positive feeling about the economy that took hold in the last quarter of 09 and the first two quarters of 2010.

As we enter the fall, the Canadian recovery is nowhere near complete from a public perspective. In fact, our hope for a better future seems to have waned over the summer. That waning confidence that was occurring in the summer is just now being picked up in real measures of the economy (with their inevitable lags).

Consumer confidence trends appeared to have a warning in them which was not understood by the economic models which predicted (until now) more robust economic growth and output. In fairness, even market researchers may have missed the big picture.

“Our economic models are… large and complicated and can be made to fit past data, but that doesn’t mean they are an accurate reproduction of the real thing” David Orrell, Economyths (John Wiley and Sons, 2010, p 33).

We need, in effect, to look for the crowd behaviour, mood or attitude that will help us gaze into the future. And the crowd matters (reflecting the broader argument of Orrell) because we are not individual, rational actors selfishly pursuing our self-interest. We are social beings influenced by what others are saying and doing. Thankfully, we are also sometimes swept up in a fresh breeze that changes the course of our collective viewpoint.

Harnessing our understanding of what people are saying, thinking and doing is required to better understand the future. This is the science (?) of public opinion not economics.