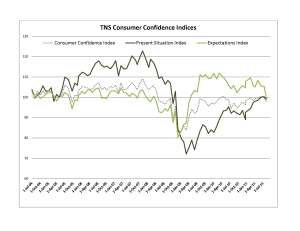

In 2004, TNS Canada produced its first Consumer Confidence Index (CCI) and it is interesting that its recent results mirror those from its first surveys. What, if anything, can this tell us about the state of the economy?

Canadians, while deeply affected by the recession, regained a lot of their confidence in the economy in spite of a fairly continuous barrage of fairly negative news. While we have not returned to a euphoric state, we have regained much since the angst of the original slide into recession.

Since 2004, we can think of the economy as going through distinct periods from a consumer perspective:

- 2004- November, 2007: Exuberance. Although expectations for better performance in the future were unchanged across the period, our sense of personal wealth and conditions continued to improve throughout the period. By some indicators, this reflected real improvement. For example, the unemployment rate declined by 7.2 to 6.0%.

- February 2008-March 2009: Crash. It took about 10 months to erase the positive gains in current perceptions of the economy before the biggest decline occurred between November and December 2008. Expectations for the future also took a negative turn.

- April 2009 to present: Rebound (?). Once confidence in the present situation hit bottom, confidence immediately started to return. In fact, expectations that the economy would turn around rose first and more clearly. Consumers were clearly feeling that the economy was going to get better and seeing some of that in their present perceptions.

But where are we now?

Back where we started. Expectations for the future are at the same level as perceptions of the present. While we would prefer that people saw better times ahead and there is clearly risk that we slide into a negative outlook, at present this does not seem imminent for most Canadians.

The next two months will probably determine whether the current period is the start of a return to negativity or just a temporary holding pattern before we return to growth.

While the stock market turmoil is no doubt the source of considerable anxiety for many Canadians, it is worth remembering that a relatively few Canadians are directly impacted by these machinations on a day-to-day basis — inflation, higher interest rates, and unemployment are much bigger problems for them.